interest tax shield calculator

This can lower the effective tax rate of a business or individual which is especially important when their reported. And an interest expense of 10 million.

Tax Shield Formula Step By Step Calculation With Examples

Discover Helpful Information And Resources On Taxes From AARP.

. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The intent of a tax shield is to defer or eliminate a tax liability. Net present value calculator.

So the total tax shied or tax savings available to. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. The following is a basic example of how interest works.

Thus interest expenses act as a shield against tax obligations. The bank wants 10 interest on it. Interest Tax Shield 3500 2500 125100.

100 10 10. Without the tax shield Company Bs interest. Cash Outflow in Year 1 Annual repayment Depreciation.

How to calculate the tax shield. Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed. How to calculate the tax shield.

TaxInterest is the standard that helps you calculate the correct amounts. Created by Lucas Krysiak on 2022-06-10 141221 Last review by Mike Kozminsky on. Companies pay taxes on the income they generate.

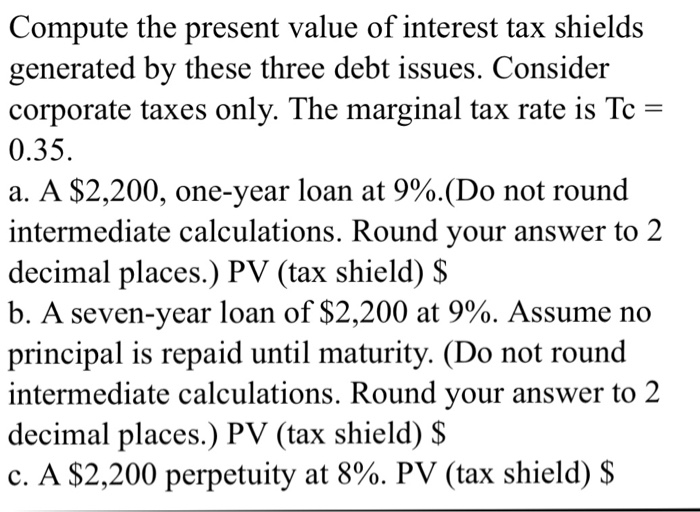

It allows them not only to conduct bigger investments but allows for tax optimization using Interest Tax Shield. In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the following example. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

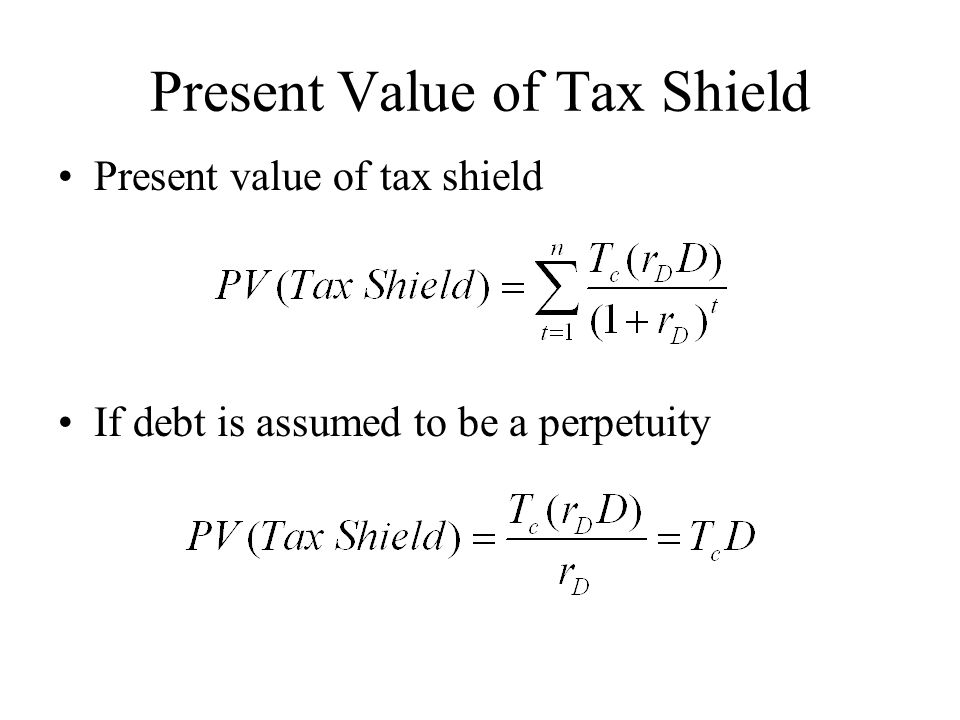

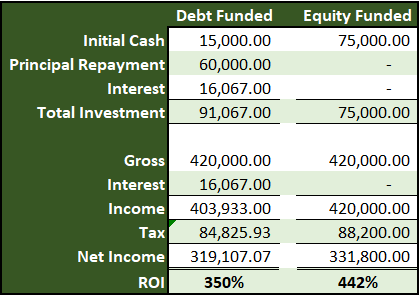

The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the. Interest tax shields refer to the reduction in the tax liability due to the interest expenses. The value of the interest tax shield is the present value ie PV of all future interest tax shields.

This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later. Derek would like to borrow 100 usually called the principal from the bank for one year. The tax rate for the company is 30.

Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900. Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Partner with Aprio to claim valuable RD tax credits with confidence.

Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million. Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution. For instance if the tax. Basically the company uses two main tax shield strategies.

How to calculate the tax shield. The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate. In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on any outstanding penalties select the Due Date on which your taxes should have been paid this is typically the 15 th of April and lastly select.

For instance if the tax. Interest Tax Shield Average debt Cost of debt Tax rate. Interest expenses via loans and mortgages are tax-deductible meaning they lower the taxable income.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

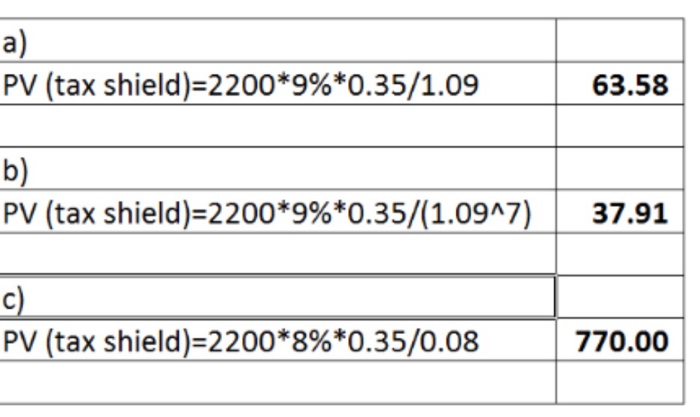

Solved Compute The Present Value Of Interest Tax Shields Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

How Much Should A Firm Borrow Ppt Video Online Download

W 4 Withholding Calculator Tax Form Updates H R Block

Tax Shield Formula How To Calculate Tax Shield With Example

5 Tax Deductions For Rental Property Bankrate

Wacc Formula Calculator Veristrat Llc What S Your Valuation

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Solved Compute The Present Value Of Interest Tax Shields Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf The Present Value Of The Tax Shield Pvts For Fcf In Perpetuity With Growth

How Tax Shields Work For Small Businesses In 2022

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Tax Shield Formula Examples Interest Depreciation Tax Deductible

How To Calculate Total Interest Paid On A Car Loan 15 Steps

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube